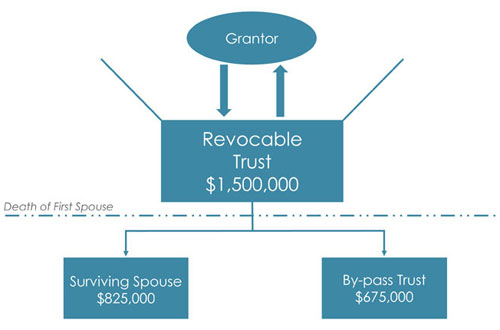

I recently worked with a client after his spouse passed away. Their revocable living trust had been drafted in 2000 by a competent attorney. At that time, the federal estate tax exemption was $675,000. The estate tax exemption is the amount of money that a person can pass at their death without paying tax. In addition to estate tax exemption, one spouse can pass an unlimited amount to another because of something called the marital deduction.

When planning for a married couple, estate planning attorneys use trusts to pass part of their money at the death of the first spouse. In 2000 it would have been common for an attorney planning for a married couple with $1,500,000 in assets to draft a trust that left the $675,000 exemption amount in a bypass trust. The remaining assets could be left outright to the surviving spouse or in a trust for her benefit. The asset allocation at the death of the first spouse would be:

The surviving spouse would have a great deal of flexibility for the money left directly to them. They would also be able to receive money from the bypass trust as needed, but the bypass trust would have less flexibility for the surviving spouse.

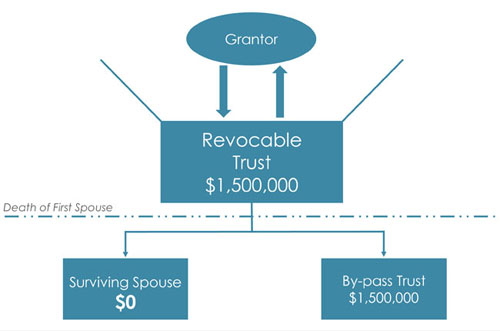

Getting back to my clients, their estate plan had not been reviewed in 17 years. Over that time, the estate tax had been amended over a half dozen times. As of the time of her death, the estate tax exemption was $5,490,000. Her trust left the maximum amount possible without tax to the bypass trust, and the remainder to the surviving spouse. Because their total assets were well below the current exemption, the actual asset allocation was:

The intention had been to leave as much as possible to the surviving spouse, while making sure that they were minimizing tax. Although the estate tax changed, their estate planning had not. Their estate was well below the $5,490,000 exemption, and no longer taxable. However, because their plan had not been updated, the surviving spouse will need to live with the restrictions of the bypass trust.

This can be easily avoided by having your estate plan reviewed on a periodic basis. For most people, every three to five years is a good time to do that review. However, if your finances are complex, or you have had major life changes, you may need to revisit more frequently. The last two major tax law changes were in 2013 and 2017. In addition to the periodic reviews, because of the major changes over the last 20 years, I would recommend reviewing any plan that meets one of the following criteria:

- if your estate exceeds $500,000 and was drafted prior to 2013, or

- if your estate exceeds $5,000,000 and was drafted prior to the most recent tax change from December, 2017.

If you estate plan includes tax planning, please contact us to discuss whether these changes impact you.

For more information on creating or updating your estate plan, contact Cameron Kelly at 715.381.7112 or ckelly@lommen.com.